Cash flow.

Two words certain to strike terror into the heart of any small business owner.

Taken at face value, these two words should be neutral; simply describing the movement of money, not its direction.

Inevitably, when you’re in business, the characteristic of cash flow that keeps you awake at night concerns money moving out of the business, not in.

For us agency owners, it’s the depletion of cash – its reduction and its lessening – that we need to focus on most. Lest that oft-feared outcome actually happens, and we simply run out of cash.

But how much sweeter is it to focus on the incoming cash? To enjoy the sight of a newly-minted completion land in our account? When once there was nothing, now there is £5,000, £10,000, or more. How sweet, but how quickly it vanishes. Into the black hole of bills – salaries, rents and suppliers – all clamouring like wildebeest at a waterhole for our last pennies.

Fear of a zero or a negative balance keeps us from looking. Best not to open the app and see that minus sign. We ostriches would prefer not to know, than to see the truth.

I’ve been you.

I’ve left statements unopened, and my bank app untapped. I’ve tossed and turned at night, nightmares of bounced direct debits plaguing my thoughts.

You’re not alone in your fears of money scarcity. When at a recent Mastermind event we asked, Who has cash flow challenges? Of the 25 agents there, almost every hand went up.

But just because other agency owners feel and act like you do, doesn’t mean it’s going to help you when you next get that text from your bank, imploring you to deposit money before 2.30pm to avoid going overdrawn without authorisation.

You can decide right here and now to break this habit. Throw off your ostrich feathers and (wo)man up to the truth. If you’re broke, own it. Accept it. And do something about it.

I can give you the tools to deal with it – they’re here, in this article. But if you don’t hold yourself accountable, and face the fact that only financial discipline will pull you out of your situation and provide you with the financial success you crave, no tool will ever help you. Only you can help you.

You already know what to do, you just need to do it.

The tools I describe in this article are not magic bullets, but if you use them and implement a healthy money mindset, your bank balance, your family – and your future you – will all thank you.

If you’re thinking you can trade yourself out of debt, you may just be creating a bigger problem. As Dave Ramsey says, “Unless you control your money, making more won’t help. You’ll just have bigger payments.”

It’s all relative. As you grow your business, the amounts in and out get larger, so instead of £1,000 in the bank, maybe you now have £10,000. But instead of your payroll being zero, now it’s £5,000. And where once you could scrape by with no overdraft facility, perhaps you are now butting up against a £10,000 overdraft, unable to find your way out of the red, and back into the green

The tools I’ve described in this article are designed to help you to not only gain control over your finances, but also to provide you with a firm foundation that will allow you to build wealth over time, both in your business, and also personally.

Getting a grip on your finances starts with…

TOOL 1: YOUR MONEY TALK

When you were growing up, what messages did you hear about money?

Money doesn’t grow on trees

Money is hard to come by

You’ve got to work hard to get to earn money

Happiness is more important than money

Rich people are selfish and greedy

The love of money is the root of all evil

Any of these sound familiar?

If so, you may be carrying ‘money blocks’ that are proving to be unhelpful to you. In her book Get Rich Lucky Bitch, Denise Duffield-Thomas describes money blocks as ‘anything that holds you back from making the money you want, usually an underlying belief or fear about money’.

Here’s a simple framework to help you uncover your blocks, and get rid of them:

1. Write down a list of all the beliefs you have about money.

2. Now take a critical look at your list. Say them out loud.

3. Are they true statements?

4. Can you absolutely know that they are true?

5. How are these beliefs affecting your success – are they helping or hindering?

6. If any are hindering your success, where would you be without those beliefs?

7. Write down the opposite of any beliefs you feel could be sabotaging your financial success.

8. Can you evidence this new statement in light of someone you know, or know of?

9. Now write an ‘if..then’ commitment for each one; in other words, what you commit to doing each time once of these beliefs sneaks into your mind.

10. Then practice – on yourself, and on others. Use that mind muscle to create a new neural pathway in your brain so that eventually, it becomes your deeply ingrained belief.

Here’s an example:

The love of money is the root of all evil

I can’t say with certainty that this is a true statement

If I believe this statement, I may be unconsciously sabotaging my business success by deterring and repelling money

The love of money may help me to achieve the financial success I want and need for my family and employees

Tony Robbins, Grant Cardone and Barbara Corcoran all seem to have a love for money, and they seem to be living lives of abundance and happiness

If I start feeling that loving money is evil, then I will make a list of all the people who are important to me, that I can help by being a financial success

Your thoughts control your feelings, which control your actions, and your actions control your results.

Therefore, control your thoughts and you’ll control your results.

TOOL 2: YOUR WEEKLY SCORECARD

Each week, we update our ‘AJ Scorecard’, which contains all the metrics and KPIs (key performance indicators) we track and measure in our agency.

The benefit of keeping a scorecard is that you can see quickly and easily if any of the numbers are out of line with a) your expectations and b) the historical data.

Here’s what ours looks like:

As you can see, we track our ‘OUTPUT’ at the top – all the activities we do each week to generate valuations.

Our RESULTS are a direct reflection of our OUTPUT metrics. Therefore, if we don’t have enough valuations in the diary, (at least 6-10 high-value valuations booked in), these are the metrics we look to for the reason why.

For example, we know that our direct mail is the most important and successful source of new valuations. If we don’t meet our target of 3 high-value valuations and 2 instructions every week, we know we need to ramp up our direct mail efforts immediately.

Two important metrics that we track are listed fees and pipeline:

Listed fees – the total of the fees we would receive if we were to sell all of our listed stock at asking price.

Pipeline – the value of the fees on the properties we have under offer, or exchanged.

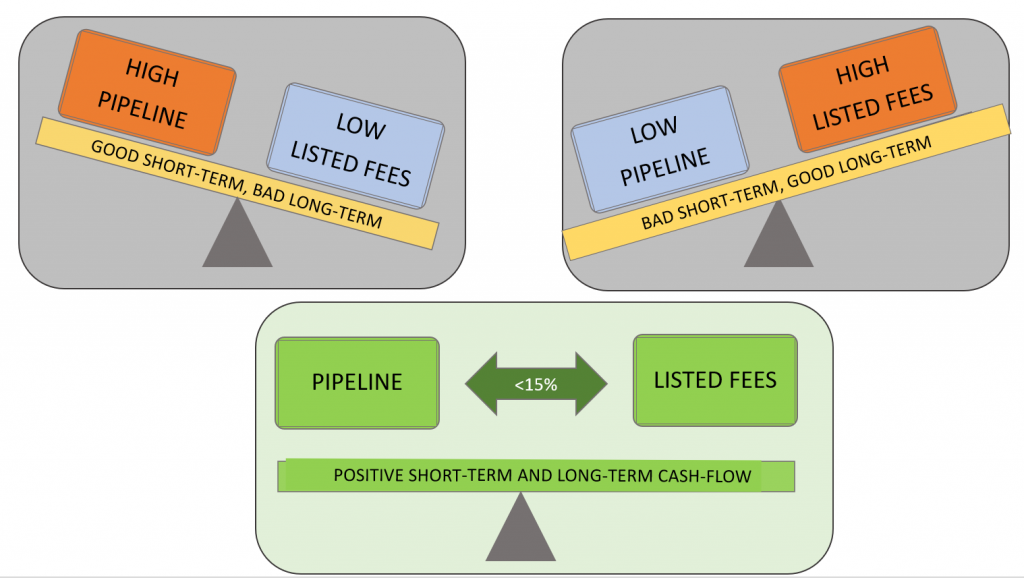

When we started recording these two metrics, we realised that they were tracking one another. We hadn’t realised until then that there was a relationship between these two figures that helped us instantly measure the health of the business. By examining them over time, we saw that when the business was at its most robust, listed fees and pipeline were 10-15% of each other. But when we felt a little exposed, due to lack of listings or too much stale stock, these two figures were out of kilter.

For example, as I write this article, our pipeline is £488k and our listed fees are £524k – a differential of just under 10%. If our pipeline is high and our listed fees figure is low, it means that whilst the next few months look rosy, there will be a point as these pipeline fees complete, where cash flow may become tight. On the other hand, if our pipeline is low but listed fees are high, cash flow might be tight in the short term, but will ease over the longer term.

The Pipeline/Listed Fees Ratio

If you want to see us explaining our current scorecard live every Friday, make sure you’re in our free Facebook group. Click here to request to join. (Make sure you answer the membership questions!)

TOOL 3: YOUR CASH FLOW FORECAST

Tame your cash flow, and you’ll have a much firmer grip on your business. If you allow your cash flow to run feral, it will bite you.

A cash flow forecast is a critical tool for your business. It will help you to improve the way that you’re controlling your cash reserves and forecasting so when an unforeseen cost appears (as it always will), or a significant completion falls out of bed, (ditto), you’re not facing a Hobson’s choice between making payroll or paying yourself.

And speaking of paying yourself, if, like many solo operators, you’re not actually taking a wage, but instead you’re just taking the ‘profit’ out, your cash flow forecast will at least tell you if the money is yours to take. If cash flow is a problem and remains one, then either you’re a) not selling enough – therefore not generating enough income, or b) spending too much – either on your own drawings, or on the operational costs of the business. There’s no ‘c’.

Cash in bank is such an important figure. It’s a measure of the health of your business. In our first couple of years of AshdownJones when cash was tight and we were constantly bumping up against our overdraft limit, we’d check the bank balance every day – sometimes several times a day – to make sure we were effectively managing our cash, avoiding failed payments and nasty letters from the bank.

Now we have more cash in the business, there’s a danger it’s all too easy to overspend. So we manage our finances with budgeting and a series of rules (eg when the balance reaches £x, move money from y to z).

Quick exercise – write down on a piece of paper the balance you think is in your company current account.

Now check it on your bank app. How far out were you?

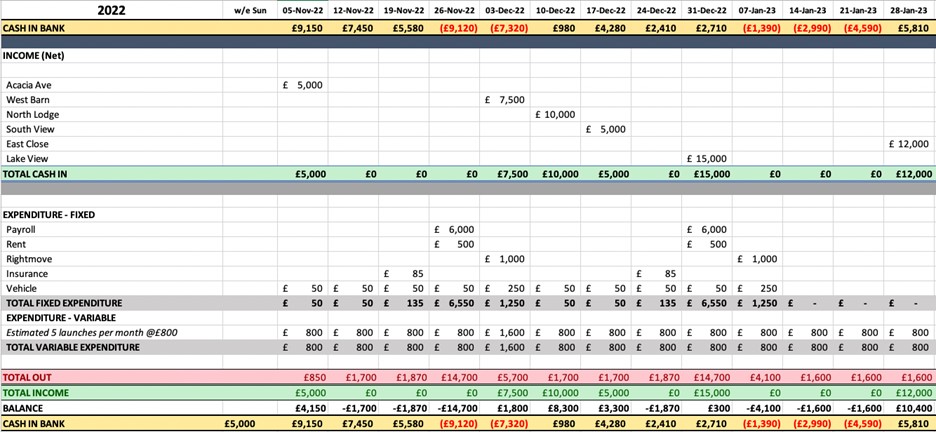

Keep it super simple – the best cash flow forecast is a very simple spreadsheet, using some basic formulas and containing just 4 elements:

1. Income

Completions

Management fees

2. Expenses

Fixed

Variable

3. Net profit (or balance)

4. Cash balance

(Do not include VAT)

You can see from the example above that unless there’s another completion, or a reduction in expenses, in the weeks ending 3rd December and 10th December, there’s going to be a serious shortfall. And then again right when you need it the least, in the first three weeks of the year.

Obviously, your list of both fixed and variable expenses is going to be much longer than this example, but be careful not to get bogged down in the detail too much. If for example, you have several very small fixed expenses each month, bundle them together in your cash flow forecast so you have less entries.

Here are some more pointers to help you plan your cash successfully using a cash flow forecast:

It’s ok to round your figures – it doesn’t have to be penny-accurate. It’s perfectly ok to round figures, so for example, instead of £189.19 you can use £190, or even £200. Keep it simple and easy to use, and that way, you’re more likely to fill it in each week. But…

Keep your eye on the money all the time – expenses do matter. If your office is anything like ours, you have Amazon deliveries arriving all the time. it’s hard to keep an eye on the little incremental spends that can add up to be large amounts. For example, a member of staff who is no longer with us decided to put in a big order for batteries to make sure we always had a stock of them. I saw the order come in, and then went through everyone’s desks and our little battery drawer to count up what we had. Grand total was 58 batteries. But here’s the rub – a third of them were batteries we had absolutely no use for – no device that needed that size! What seems like an insignificant expense, that would never be questioned by your bookkeeper or accountant, can actually turn out to be an insidious drain on your cash, leaving you scratching your head and wondering where all the profit went.

Your cash flow forecast can keep you informed on more than the flow of cash – used effectively, your cash flow forecast can help you to not only accurately forecast your finances, but also to identify fundamental challenges in your business so you can fix them before they become disastrous.

You don’t need to reconcile your cash flow forecast – you don’t need to go back through the past entries and check it’s correct against your actual income and expenditure. Just start from now – today – and work forwards. Nothing before today matters for your cash flow forecast.

Forecast for the next 12 months – there’s no reason why, as an estate agent, you shouldn’t forecast for a year ahead. It’s crucial to know how long your business can survive on its current pipeline, even if you don’t sell anything from this point forwards.

Remember that this tool is only for your use – you don’t need to show it to your accountant, and nor will HMRC be interested in it. Therefore, its only use is as a forecasting tool for your business. Make it work for you.

‘Do not save what is left after spending; instead spend what is left after saving.’ – Warren Buffett

TOOL 4: YOUR DASHBOARD

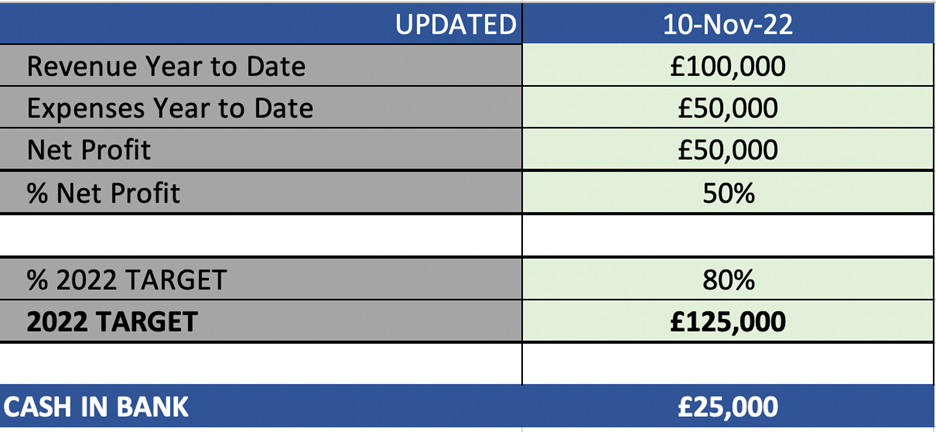

Every Monday morning, we create a snapshot of the financial health of our business. In this, we’re looking for red flags in terms of cash in and cash out. Our dashboard is super simple; it lists just the important stuff we need to know at a glance:

- What cash have we banked this year?

- What expenses have we paid out?

- What’s the difference between those two figures?

- How much do we have in the bank today?

Here’s what our dashboard looks like (figures are fictitious):

As you can see, I’ve added in an extra section for where we’re up to on our revenue target for the year. This helps us keep on track with our overall financial goals.

Our actual dashboard is more complex than this one, as we now have two branches (Lakes and Dales), and a group account (The AJ Group). But if you have one main business bank account, the one above is all you need for your own dashboard.

‘Good fortune often happens when opportunity meets with preparation’ – Thomas Edison

TOOL 5: PROFIT FIRST

This is a book and also a system, (super helpful video here). Created by Mike Michalowitz, it’s a way of apportioning money as it comes in, rather than waiting to allocate it to bills, VAT etc.

When I got my first full-time job, my dad taught me the ‘envelope’ system of accounting. Back then, I got paid weekly in cash, (£68! Well, it was 1984…), and he showed me how to divide my pay into envelopes for expenses like rent, car, bus fares, and also for things I wanted, like clothes and going out.

It worked brilliantly, until I got paid into my bank account. At which point I simply spent what was still in my bank account, after I’d paid my rent and petrol. Trouble is, my car insurance would roll around, or a friend would invite me on holiday, and I’d have to go ask Bank of Mum and Dad. At which point Dad would remind me of his envelope system….

The Profit First system is just like my Dad’s envelope system, only you need bank accounts instead of envelopes.

Here are the 4 accounts you’ll need:.

1. Operating Expenses

2. Profit

3. Tax

4. Owner’s profit

(NB Michael suggests 5, including an ‘income’ account, but you can get by with 4.)

All income goes into your Operating Expenses account. Twice a month, on the 10th and 25th, distribute the cash according to these percentages:

50% – leave in Operating Expenses

15% to your Profit account

20% to your Tax account

15% to your Owner’s Profit account

These percentages are not set in stone, they’re simply my recommendations. Every business is different, so make sure you monitor your own percentages and tweak as necessary. It doesn’t actually matter the exact percentages you use, so long as you create a system, then stick to it.

The purpose of the Operating Expenses account is to pay all your variable and fixed costs from. Rent, car leases, photography – it all comes out of your OpEx account.

Your Profit account is where you’re going to build up a ‘buffer’ in your business, both for unforeseen costs, and to create money for investment, eg to open a new branch. Every quarter take out 50% of profit for you, your savings, or just for spending, and leave the remaining 50% in the account.

Your Tax account is where you save up for VAT, Corporation tax and PAYE. It’s not your money! Put it there and don’t take it out, other than to pay HMRC in one way or another.

The Owner’s Profit account is where you pay yourself from. It’s your regular ‘salary’ that allows you to cover all your personal expenses.

The Profit First system is a bit of a faff to set up, (especially at the moment, when opening a new bank account is harder than starting a new business), but once you’ve done it, you’ll find it frees you from the temptation to see all of the cash in your main bank account as there for the spending. Or conversely, to be so worried about spending, you’re not investing in the areas of your business that need it the most.

BONUS TOOL: GO HENRY

I came across this tool when I was trying to figure out how to pay weekly pocket money to my 12-year old grandson Riley.

Me and Riley at his first musical at the Lowry in Salford

GoHenry, as its website states, is a prepaid debit card and app for kids, to help them learn how to budget, and ‘grow to understand the difference between wants and needs by spending wisely.’

I have one for Riley, and I just transfer a fiver a week automatically each Saturday morning. He can then spend it in any approved location, (eg, not a pub), and you get a notification showing their spending activity.

It gives the child, or teen, independence, whilst still keeping a level of control and monitoring. I love it!

If you enjoyed this article, and whenever you’re ready, here are the three ways I can help you to grow your agency:

1. My book, The Selective Estate Agent, is a thinly disguised guide to how we started our estate agency, and how we consistently maintain the highest market share for high-value homes in the Lake District.

2. Our free Facebook group is full of tips and tactics that you’ll find super useful on your journey to the agency of your dreams.

3. Come join us on a FREE Behind the Scenes at AshdownJones day, at our HQ in Windermere. More info here http://www.ajmastermind.co.uk/events

What to read next: What do you stand for?